SecLink Poll predicts 2024 secondary market volume at ~$124 billion

2024-01-04

By Priyanka Iyer

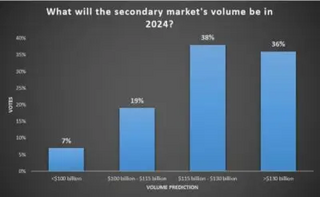

With current market conditions aligned to support strong secondary market activity, buyers are optimistic about the market’s growth and predict a volume jump in 2024. The weighted average outcome of a recent SecLink poll predicts secondary market volume at approximately $124 billion for 2024.

For 2023, advisors have predicted a volume of anywhere between $100 billion to $118 billion. Jefferies expects 2023 to close with a volume of $100+ billion, while Setter Capital’s H1 Volume Report said buyers expect the year to close with close to $110 billion. PJT Partners is eyeing a similar range, predicting volume to be between $100 billion and $110 billion. The most bullish projection is by Lazard, which expects $118 billion in volume in 2023.

In response to the SecLink poll, 38% said they expect 2024 to end with $115 billion to $130 billion in volume. Imran Hussain, Principal at Cedar Springs Capital, agrees with the poll’s majority outcome.

“I believe volume for 2024 will be in the range of $120 billion with an almost equal transaction volume between LP-leds and GP-leds. Activity seemed to notably gain momentum in the back half of 2023, and I expect that acceleration to carry well into 2024,” according to Hussain.

Julien Marencic, Founder and Partner at Jera Capital, also expects this outcome, estimating a volume increase of 10% to 20% in 2024.

“The key reason for the projected volume growth is the increased availability of capital, fueled by the fundraises in 2022 and 2023. Secondly, the bid-ask spread has narrowed, which will help close transactions faster,” he said.

Besides these factors, Marencic added that continued liquidity constraints will also drive volume. The lack of liquidity is unlikely to change anytime soon, with interest rates expected to remain high for a large part of 2024, he said.

36% of respondents estimate volume to be over $130 billion in the year, reflecting higher optimism about the market’s growth prospects.

William Barrett, Co-Founder and Managing Partner of Reach Capital says this growth will be driven by the persistent tepid exit environment and the growth of secondaries in certain asset classes.

“The secondaries market is expected to reach new record heights in 2024 with a projected deal volume of $149 billion,” he said. “This will be supported by an increased sophistication of LPs, a

challenging fundraising and exit environment as well as the growth of new market segments within the secondaries market, namely private credit and infrastructure secondaries.”

Managers will also access the secondary market to clean up or exit portfolios that are at the tailend of their investment cycle. Christoph Landolt, Investment Manager at tail-end liquidity

solutions provider Multiplicity Partners, expects a massive increase in deal flow in this segment of the market.

“The exit environment remains difficult, especially for GPs and LPs looking for tail-end solutions. We see a lot of interest from LPs looking for tail-end portfolio clean-ups. This was very

much true for Q4 of 2023, and we expect it to extrapolate to 2024,” he said. Another structural change that buyers said would drive growth is the wider acceptance of secondaries as an exit strategy. Tim Bemer, Partner at Lead Edge Capital, and Zach Ullman, a Principal at the firm explained, “Many felt that selling in the secondary market was damaging to one’s reputation as an investor. Since then, the secondary market has gone through its own glow up of sorts. The secondary market is what we consider to be a liquidity release valve.”

This also specifically applies to GP-leds, which were earlier not seen as a traditional exit choice but are now a more mainstream strategy. Jefferies has predicted GP-leds to constitute 45% of 2023 volume.

“The consensus is that we should see a strong 2024 for GP-led secondaries. Investment bankers are telling us that they are prepping a lot of mandates that should hit the market. The GP-led

solution, especially continuation vehicles, is becoming more mainstream with each passing year,” said Paul Cohn, Founder and Managing Partner at Tail End Capital Partners.

Cedar Springs’ Hussain added that several GP-led processes were postponed in 2023 amidst the flood of supply. “We should therefore see several new GP-led opportunities introduced in Q1 2024 as that pipeline queues up,” he added.

However, buyers also warn that volume growth could be impacted by unforeseen macro, political and geopolitical developments that may evolve in 2024. Cohn also pointed out that despite mega

fundraises, there is still a dearth of capital on the GP-led side, specifically for single-asset continuation funds. This could prove to be a growth inhibitor. Single-asset continuation funds constituted 45% of GP-led volume in H1 2023.

“An inhibitor to growth is the amount of capital. There is about one year of dry powder in the secondary space compared to nearly three years of dry powder in the PE space. The lack of capital is particularly an issue for single-asset CVs and will likely remain so in the near term,” he said.

Lastly, 20% of the poll’s respondents expect a marginal increase in volume, predicting 2024 to end with $100 billion to $115 billion. Only 8% expect 2024 volume to drop below the predicted levels of 2023, i.e., below $100 billion.

Secondary market intermediaries will soon release the final volume numbers for 2023 and their projections for 2024. Watch out for our comprehensive coverage of 2023 reports, including their views on volume, pricing and trends.